How to use NPS surveys to create the best customer experience

In the face of an economic downturn, acquiring new customers becomes increasingly difficult. As a result, many companies lean into the business-smart goal of retaining their existing customer base.

After the economic challenges of the past few years, this focus on customer relationships is more important than ever. Companies need an effective process for measuring customer sentiment to monitor customer health. Establishing a Net Promoter Score (NPS®) program is an excellent starting point.

According to our research, 48% of business leaders believe that a strong customer experience (CX) gives them confidence that their company will weather the storm of an economic downturn.

Luckily, NPS surveys can help you maintain that edge and deliver the best possible customer experience, even amidst adversity.

What is NPS?

NPS is a metric that gauges the strength of your relationship with your customers and their loyalty to your business with just one question: “How likely are you to recommend us to a friend or colleague?”

Customer satisfaction affects word-of-mouth recommendations and indicates areas for improvement in your business. By tracking this metric and using it to guide your CX efforts, you can build long-lasting customer relationships, increase revenue, and reduce churn.

Benefits of NPS

NPS is a powerful tool for all kinds of businesses, across all industries. Here are just a few of the most significant benefits of NPS:

NPS is intuitive and easy to use

With just one standard question based around one simple idea—likelihood to recommend—NPS is an intuitive system to understand.

Once you’ve sent out your survey and gathered your data, calculating your score is straightforward. Your score will be a singular number, which you can measure against others in your industry. You can even integrate NPS into CRM systems such as Salesforce.

NPS is great for leadership

NPS makes it easy for leaders and executives to quickly understand where the company currently stands in customer loyalty and satisfaction. It also allows managers to swiftly spot areas for improvement in different departments or experiences. For example, comparing customer service phone support NPS ratings versus a website chatbot’s ratings can help you identify and address pain points in the customer journey.

NPS helps quantify and measure customer loyalty

Loyalty is a very abstract concept, and measuring how likely customers are to stay with your business for the long term has historically been difficult. Customers could be frequent purchasers, satisfied buyers, big spenders—and still not loyal to your business.

NPS solves this problem, acting as an effective measure of customer loyalty, and can even be used as a benchmark to propel growth.

NPS allows for detailed feedback

Getting your NPS is a great first step—but there’s so much more your NPS questionnaire can do than just provide you with one number. Adding in an additional open-ended NPS survey question allows respondents to explain why they feel the way they do about your business.

You can ask the standard question: “What is the primary reason for your score?” Or you can create a unique follow-up question for customers. Either way, you get detailed feedback on what’s behind the customer rating—and that’s highly valuable for understanding issues and surfacing wins. For example, we recently conducted a study on NPS around the world and uncovered that quality and ease of use are leading drivers of NPS.

NPS identifies your most loyal advocates

When you know who your most loyal customers are, you can reach out to them to get testimonials for your marketing, invite them to join your referral program, encourage them to share their positive experiences on social media or online review sites, and more.

NPS is a fast, simple way to identify those advocates so you solidify those connections and cultivate them further. You can also use this knowledge to dig deeper into what makes your customers become advocates so you can replicate that with less-satisfied customers.

NPS builds relationships

Your NPS is a fantastic stepping stone to building long-lasting bonds with customers because it allows you to gather qualitative and quantitative data on their wants and needs. From there, you can use those insights to help your customers in concrete ways and hone your customer experience strategies.

The Net Promoter Score (NPS) survey

NPS asks, "How likely are you to recommend us to a friend or colleague?”

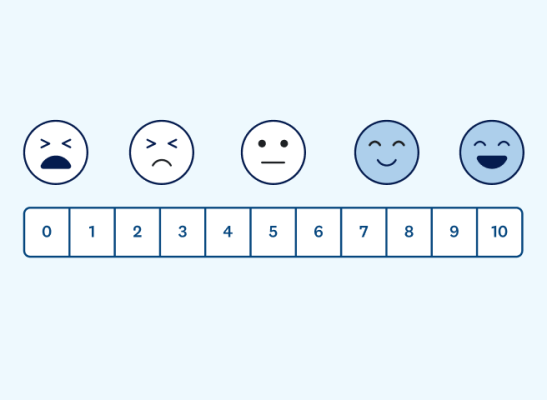

The respondent ranks their likelihood on a scale of 0 to 10, with 0 being highly unlikely and 10 being extremely likely. As mentioned above, you can also add an option for the respondent to leave an open-ended comment and explain their rating.

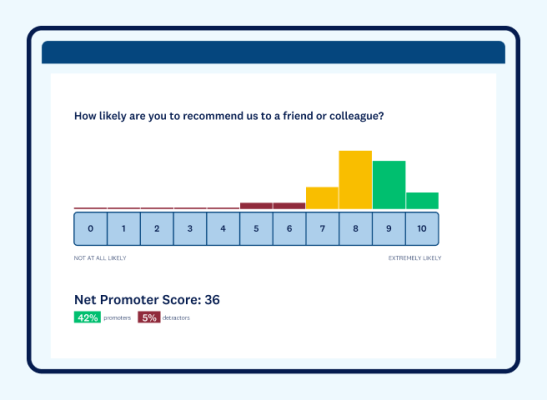

On the rating system, people who select 9 or 10 on the NPS survey are considered "promoters," as shown in green below. People who select 7 or 8 are “passives,” as shown in yellow, and people who select 6 or below are “detractors,” as shown in red.

To calculate your NPS, you’ll need to subtract the percentage of detractors from the percentage of promoters (% promoters – % detractors = NPS).

You’d see a score of -100 if you had nothing but detractors. Whereas if you had only promoters, you’d have a perfect 100. Realistically, anything above 50 is great, while anything above 70 is fantastic. If you want to dive deeper into this topic, check out our blog post on measuring NPS.

What can an NPS survey tell you?

Measuring NPS data and combining it with other business metrics lets you gather insights that are hard to get otherwise.

For instance, some customers might generate large amounts of revenue but still seeking services elsewhere. Others may be generating little direct revenue, but are very satisfied with your brand and are creating revenue indirectly through positive word-of-mouth reviews.

Compared to other survey options, such as a Customer Satisfaction survey, NPS can seem like a blunt instrument because it asks just one question for a very broad-strokes picture of how customers view your company.

But with an NPS survey, you can uncover actionable data. You do this by segmenting your customers by various metrics, such as how long they’ve been your customer, which products they buy, their demographic, and so on. For example, if you find that most of your detractors are first-time users under the age of 35, that is a powerful insight that will allow you to address the concerns of those specific users.

Implementing your NPS survey

Next, let’s look at the best practices for designing and distributing your NPS survey.

How to design a great NPS survey

How you design a survey can affect brand perception, and your survey results—and NPS surveys are no exception.

You’ll want to ensure the text is clear and easy to read, especially if using a background image. You should also double-check that your survey looks great on mobile browsers and all the platforms you’ll be sharing it on. And don’t forget that your survey should include your brand’s colors and imagery.

You also want to design questions that will provide actionable feedback.

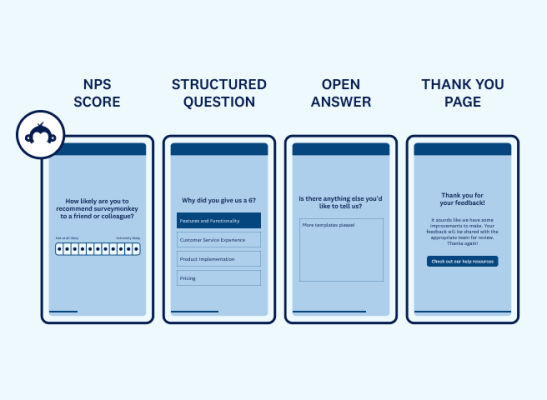

- We recommend starting with the standard NPS question so you put your most important metric first.

- Then include a structured question to get deeper insights. This will help you report on themes contributing to negative or positive scores.

- Include an open text field to garner more qualitative feedback. Then use text analytics to understand the sentiment, identify keywords, and spot trends.

- Close with a custom thank you page. Consider taking respondents to a custom URL via your survey end page. This is a great way to promote other relevant content—like customer stories and help center resources—or ask promoters for reviews.

For more on survey formatting, check out our survey design best practices.

Where to ask the NPS question

NPS is such a quick and easy survey experience that it works in a variety of contexts, whether it’s email, your website, social media, or SMS (text messaging).

Ideally, you should share the survey in the same channel that the customer recently interacted with your business. For example, if you have just closed out a tech support ticket where the customer was helped via email, add the NPS survey into the email exchange right after confirming the resolved issue.

When to ask the NPS question

The timing of your NPS surveys is very important. Here are two main ways to get the NPS question in front of your customers:

- In regular intervals

- In real time

The first option involves launching your NPS surveys on a set schedule. It’s a good practice to send your NPS survey to a customer 60 or 90 days after purchase, or a few weeks before renewing.

That way, each day, you get a small, manageable set of responses from customers who signed up 60 or 90 days ago. You can then use this data to track their satisfaction level against events in your business cycle. Are you testing new onboarding emails? Did you release a new product at a crucial point right after they purchased it?

This can reveal valuable pain (or happiness) points, letting you identify at-risk accounts and gaps in the customer experience. You can even incorporate your NPS results with Salesforce, so teams across your company can better understand how to optimize customer touchpoints.

The second option is to send your NPS survey in real time after you resolve a customer support case. Take these responses with a grain of salt, of course, as the customer may be feeling especially strong emotions at that moment. But those emotions can still be learning opportunities, indicating an engaged customer who may be ready to become more or less loyal to you.

You may be wondering: How can I make sure a given individual customer isn’t annoyingly receiving my NPS survey every other day as part of one or the other of these groupings I’ve created?

It’s good to make sure you’re not annoying people, but because an NPS survey is so low-effort, and because people’s feelings change over time, it’s actually not a bad thing if you share it more than once with each customer—as long as it’s within reason.

Why you should send an Employee NPS survey

Remember that your customers aren’t the only ones who can reveal vital insights about your company. Great customer experience starts with happy employees, and you can learn a lot when you regularly survey your teams.

Employee NPS (or eNPS) surveys can provide valuable insight into how engaged your employees are, especially when done at regular intervals. Typically the NPS question in this context is: “How likely are you to recommend [company name] to your friends and family as a place to work?”

Segmenting eNPS results (by team, tenure, and demographic) and asking follow-up questions can provide key action items for management and HR teams to work on.

Qualitative open-ended NPS survey questions

The “likelihood to recommend” question is often just one piece of the NPS picture. As we mentioned, one of the benefits of an NPS survey is that you can get detailed feedback to understand why a customer or employee rated your company, products, or experiences the way they did. From there, you can make the right improvements or adjustments.

Open-ended NPS feedback is especially useful when your customer service team follows up with detractors. With those insights, they’ll know the issue before they even contact the customer and will be better equipped to address it quickly and mitigate any bad feelings.

The best open-ended NPS questions are customized based on the respondent's rating in the “likelihood to recommend” question and the additional details you hope to collect. Using skip logic can help you ensure that the open-ended question each respondent sees is relevant for them, so detractors don’t see positively-phrased questions and promoters don’t see the opposite.

Here are some examples of open-ended NPS survey questions that can prompt helpful feedback:

What did you like most about our product or company?

Asking promoters to specify why they rated you so highly can yield insights about what your company is doing well. You may discover new aspects of your strengths that you can use to develop future products and services. And you can use this feedback as social proof in advertising or as a testimonial.

How can we improve your experience?

For passives and detractors who haven’t had a positive experience with your company, asking this question can surface what’s going wrong. You’ll be able to prioritize fixes to your products, services, or overall customer experience based on the answers to this question.

What features did you like the best?

This question is beneficial if you want to uncover what promoters love about your products. You can use it to learn what it is about your product that delights your most loyal customers and use that information in your marketing strategy and sales process.

What features did you like the least?

On the other hand, this open-ended question can reveal flaws or issues in your products so you can make improvements. Ask your passives and detractors this question in a product-focused NPS survey. Perhaps a new product isn’t selling as well as you’d hoped, or you’re getting more returns than usual. This question can pinpoint the problem.

What is the one thing we could do to make you happier?

This question accomplishes two critical things. First, it helps close the customer feedback loop with your passives and detractors so that you can turn them into satisfied customers and promoters. The question phrasing also shows your customers that you care about their happiness and want to make updates based on their thoughts, opinions, and wants.

What was missing or disappointing in your experience with us?

Getting customer feedback on what dealing with your company is like is important—especially if it was a less-than-ideal experience. Ask your detractors what was missing that made them rate you so poorly so you can do better next time, and offer a customer service solution for whatever went wrong in the interaction.

Interpreting your NPS survey results

Once your NPS responses start flowing in, it’s time to draw out meaningful insights. Here are a few ways you can do that:

Analyze the numbers

In addition to collecting timed and segmented NPS survey results—which we explored in a previous section—you can take the mass of data from all the responses and break it down by relevant user demographics.

Let’s say your company sells weighted blankets. The primary reasons for using the product, daily habits, and experiences may vary considerably by users’ age, geographic location, gender, and so on. For example, people may use your product to help with anxiety, sleep better at night, or even relieve chronic pain.

In this scenario, you’d graph your NPS responses against each segment. Knowing that all your customers that use the blanket primarily for better sleep are giving 9s and 10s, but you’re getting 3s and 4s from those using it to help with anxiety will provide you with invaluable insights to share with your product planning and marketing team.

Interpret the comments

If your NPS survey includes an option for open-ended commentary in addition to the 1-10 rating question, go through the comments in detail to capture quotes and summarize common themes. Use text analytics tools to quickly see if themes and topics emerge that can lead to actionable insights. This is where machine learning-powered text analysis will come in handy, unearthing actual trends when the number of comments is too big for a human to analyze accurately.

Sharing NPS survey results

Your NPS survey insights can spark all kinds of cross-functional collaboration, and it’s a great idea to regularly practice sharing your results with your broader team and organization. That information builds internal team understanding and helps make everyone feel involved and invested in your customers’ experiences with the product. It also motivates employees, letting them know they’re doing a great job giving customers the best possible experience.

You can present your NPS survey results creatively, from presentations, documents, and word clouds to displaying a screen somewhere prominent in your office showing real-time customer happiness levels.

What is a good Net Promoter Score?

Now that you’ve calculated your score, how do you know how it stacks up?

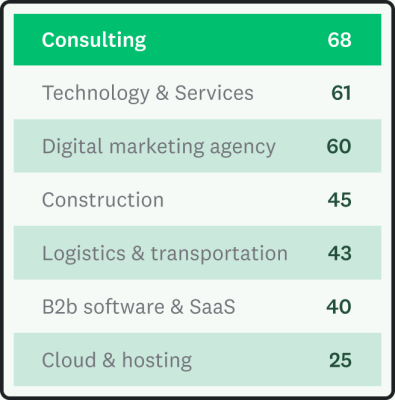

We mentioned earlier that, in general, an NPS above 50 is good, and above 70 is fantastic. But your NPS can still feel like just a number, unless you have a sense of whether your result is above or below average.

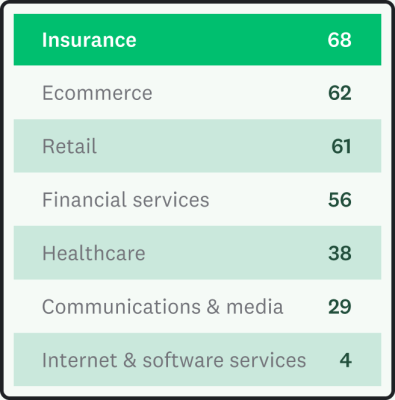

It probably won’t surprise you to learn that NPS varies widely by industry. We’ve documented some NPS industry benchmarks to help orient you within your market.

Of course, external benchmarks are great, but they’ll only take you so far. You should be competing against yourself to do better always—so use your score internally to push your customer experience to the next level. That’s how you build a successful business with highly loyal, satisfied customers.

What to do with feedback from the NPS question

Once you’ve gathered and analyzed your NPS survey feedback, what comes next? Your insights can serve as a guide for next steps, and you should take different actions depending on the categories your respondents fall into.

Follow up with customers through email

If you’re sending out hundreds or thousands of NPS surveys every month, you’re not going to be able to follow up with each respondent personally. But when you’re getting either positive or neutral feedback, you really don’t need to—a simple thank you message after they submit their survey is all they expect.

However, when you receive negative ratings and feedback from your detractors that mention a specific negative experience, it’s vital to check in with them via email. If it’s possible to fix the issue, a customer service rep should do so. Otherwise, offering a sincere apology or a future discount as a peace offering can be effective. When you make customers feel heard, you might even turn them into a promoter in the process!

Feed NPS data into your CRM or Salesforce

Your CRM holds a wealth of information about customers. Add their NPS data to the list. What this will look like in practice depends on your CRM. You can add NPS ratings and verbatim feedback and track scores over time.

You can also use your NPS data to determine trends in your ratings. You will have a pattern to investigate if you consistently receive very low scores from a certain customer demographic. This could also lead to important adjustments in your product, customer service, or ideal customer profiles.

Learn from your open-ended feedback

Feedback from detractors can be hard to hear, but it’s best to look at it as constructive criticism that helps you pinpoint weaknesses and flaws in your business. Their feedback can also help you solve problems proactively before detractors air their complaints to their network or social media. They may even remain a customer if you fix the issues fast enough.

Open-ended feedback from your passives tends to be less extreme, but it can help you determine why they’re reluctant to recommend your company even though they’re not displeased with your business. You can use this feedback to solve pain points that keep customers from becoming enthusiastic referrers.

And feedback from your promoters isn’t only great to hear—it can also help strengthen your company. Promoters often point out your business’s strengths and what you’re already doing well so you can build on that foundation.

Ready to discover the power of NPS?

Customer loyalty is about more than just transactions. With NPS surveys and data, you can capture the essence of your relationships with every customer and uncover opportunities to improve those relationships.

Follow this guide to make the most of NPS surveys and put your score to work alongside SurveyMonkey’s flexible, active, and powerful platform.

Use NPS to build a loyal customer base

Automate your Net Promoter Score program so you can spend more time acting on customer insights.

Net promoter, Net promoter Score, and NPS are trademarks of Satmetrix Systems, Inc., Bain & Company, Inc., and Fred Reichheld.